Sand Mining In America

Originally posted on my blog www.civilnotion.com

Originally posted on my blog www.civilnotion.com

It’s Not Just About The Sand

The other day I bumped into a friend who’d just returned from a visit home to Wisconsin. Naturally enough, I asked how the trip was.

It’s always great to catch up with family and friends, but I was really surprised — and not in a good way– by the number of farmers in the area leasing or selling their agricultural lands to a sand miner operating in the area.

Can’t really blame ’em, I suppose. Checks in the mail from leases must be a welcome change from the uncertainties of the weather and commodity prices.

My Uncle Zeke said a friend of his around Tunnel City sold 130 acres for $1.5 million to a mining company, when its farm value was only somewhere around $225,000.

Sand mining–really? I was too embarrassed at the time to ask her to elaborate; fortunately for me, she had to dash and never saw that look of duh-umb on my face.

Of course, I was aware sand is used by frackers to unlock oil and gas deposits in rock formations. I’ve penned warnings of down-the-line dangers of reliance on natural gas as a bridge to somewhere sustainable; I’ve even listed some of the environmental threats posed by mining operations.

Beyond its use by drillers and its presence at the beach, I’ve never really given sand much thought.

Wanting to have something clever to say should the topic ever come up again I spent time a few days later wandering the net. What I learned was surprising. Much more than that- it was disturbing.

It is impossible to cover in any real depth the ins, outs and otherwise(s) of sand and sand mining in an article like this. If I can increase understanding of the relationship between this ubiquitous resource and a sustainable and just world economy–in even a minor way — it will be time well spent.

To state the obvious, sand mining is — mining. Whatever one might be digging for at the end of their personal rainbows — coal, gold, a short cut to China, or sand — it involves a violation of earth’s surface.

In kind, sand mining isn’t much different from bulldozing mountain-tops to get to the coal beneath them. It poses many of the same risks to nearby aquifers, streams and rivers. Like other large mining operations, it can stress community infrastructure, e.g. roads, and diminish air quality through release of particulate matter.

Mining has always struck me as the earthy equivalent of invasive surgery. Before rolling your eyes at my anthropomorphizing Earth, let me tell you I am not alone in ascribing personhoodto our Mother.

The New Zealand government recently accorded the Whanganui River the right to counsel in a court of law. An Indian High Court, within the past month or so, declared the Ganga and Yamuna Rivers persons, giving them legal standing to seek remedies for harms done.

This same court subsequently added to the list of potential plaintiffs two of the Himalayan glaciers feeding these same sacred streams. So, I advise you to be careful of what you say and do to the ground you might be standing on, lest you become a defendant in a tort case. (see also K. Cobb)

Sand is as essential to the built environment as bulk elements are to animate beings. Modern mortar was invented in 1794 by Joseph Aspdin. Cements of some sort, however, date back tens of thousands of years–at least to 6500 BCE and the Neolithic community of Mehergarth in Pakistan’s Indus Valley.

Every civilization, kingdom, empire, developed and developing nation–almost since the first construction–has relied on sand. Without it, Donald’s beloved wall would tumble faster than Jericho’s — no trumpets needed.

Rarely in history has the cash value of this ubiquitous commodity ever been greater and the potential supplier lower. On sand stands much of Singapore; it is currently the biggest importer. Expansion of the island-city-state’s territory by 130 square kilometers has erased two dozen Indonesian islands in the process.

Singapore is far from the only Asian nation whose future is being built on shifting sands. According to a 2016 article in The Sydney Morning Herald:

Just two years ago a small sandbar could be seen jutting out of the narrow straits separating Singapore and Malaysia’s Johor.

Then the barges came, disgorging tonnes of sand, the beginning of a $60 billion, 20-year Malaysian development of four man-made islands designed for 700,000 residents and 25,000 workers, called Forest City.

Sand is an integral element in a tremendous array of manufactured products and industrial practices, ranging from cement to the production of silicon chips for PV panels, other electronics, glass manufacture and, of course, fracking. Currently, the sale of an estimated 40 billion tons of the stuff generates around $70 billion globally.

Demand for industrial silica is expected to grow worldwide, in excess of 5.5 percent over the next several years. Sand sales for construction and fracking purposes will grow by much larger percentages. *

Frac Sand in the U.S.

Fracking sands are primarily mined in an open pit process. The mining cycle starts with the removal of top soils — called overburden — and ends with backfilling the left-over materials. The smoothed over surface is not the same fertile field it was before its violation.

In between, a series of processing steps occur. These include: successive washings, drying, storage and transport out of the mine.

As a referent, 130,000 tons of frac sand would fill 40,000 Olympic-sized swimming pools. An Olympic pool measures 82 feet wide by 164 feet long with a minimum depth of 6.5 feet, for a calculated volume of 88,263 cubic feet.

Not all frac sand is created equal. Great Lakes and Texas sands are highly prized for their chemical purity, grain size, shape, and distribution. These areas of the country are the nation’s largest suppliers.

Raymond James, in a January investor’s note, estimated demand in 2017 would hit roughly 55 million tons and likely to exceed 80 million tons in 2018. The 2018 number equates to a 60 percent increase above previous 2014 records.

Companies are worried the demand for frac sand will soon outstrip supply. Today’s rising prices reflect these concerns.

In the second half of 2016 the price for a ton of frac sand was between $15 and $20. Already in 2017 prices are heading to the $40/ton mark, with a promise of going much higher should demand begin to outstrip supply.

The $40/ton price is still considerably lower than the $65/ton average paid peak price fetched in the last half of 2014. The current discounted price is proving an incentive for companies to purchase in advance of a tightening markets over the next several years. The Trump administration’s desire to expand U.S. fossil fuel production is also being factored into the supply/demand equation.

Although frac and construction sands are not in direct competition because of their different properties, should Trump succeed to wall Americans in and Mexicans out, it would place significant pressure on U.S. sand supplies. A vigorous national infrastructure program — either alone or in conjunction with border security–would only compound pressures.

In the first half of 2016, demand for frac sand was down. It recovered rapidly later that year. Relatively rapid shutdowns and startups is a characteristic of the sand mines. Several years back, for example, Cadre Proppants ramped production from 0 to 1 billion pounds of shipments to the Eagle Ford and Permian Basin fields in less than a year.

The U. S. Geological Survey estimates that between 3,000 to 10,000 or more tons of sand are used per natural gas fracking well. Sand volumes per well are on an upward track due to improved methods allowing access to deeper wells.

These advances are offsetting decreases in the number of operating drill sites. There were around 1500 operating wells in 2014, when frac sand prices reached an apogee, today the count is 591 and may rise to as many as 1000 in 2018.

The biggest U.S. shale fields get fracked with about 30 percent more sand every year, according to Phillip Dunning, a technical adviser at Drilling info, which tracks oil-field supply use.

The record of 50.2 million pounds of sand down a gas hole is held by Chesapeake Energy Corporation for a 1.8-mile-deep horizontal well in Louisiana. Not to be outdone, other oil and gas producers are now revisiting their estimates of the wells that can still profitably produce because of deep fracking.

Recall, Uncle Zeke had mentioned a fellow farmer who sold his 130 acres — likely without the mule — for an estimated $1.5 million dollars. Noble Energy recently acquired 71,000 acres in the Delaware Basin.

The company considered the new acquisition proximate enough to the 47,200 acres it already owned in the area to realize substantial economies of scale. In addition, Noble took ownership of another ~100,000 net acres in other parts of the Permian Basin. At a base assumed price of $50/bbl for 2017 and with modest price acceleration through 2020, Noble anticipates a pre-tax rate of return on capital of 60 percent for its Delaware Basin properties.

Construction Sands and Aggregates in the U.S.

Sand and gravel for industrial and construction purposes is a multi-billion dollar industry. Like frac sands, construction and industrial demand is pegged to economic cycles. The more houses built and roads constructed and repaired the more is sold.

The U.S. Geological Survey estimates that $4.2 billion worth of the stuff was produced by just 118 companies with operations in 33 states in 2015. In order of tonnage produced, the leading states were: Wisconsin, Illinois, Texas, Minnesota, Arkansas, Oklahoma, Missouri, and Iowa. Together these states accounted for almost 80 percent of the U.S. production.

To offer a visual of the numbers:

One mile of four-lane interstate highway requires 85,000 tons of aggregates, i.e. sand, gravel;

The average six room house in the U.S. takes 90 tons.

The Hoover Dam required 8.6 million tons of concrete*.

To sharpen the picture a bit more: [the concrete] used in the Hoover Dam would build a monument 100 feet square and 2–1/2 miles high; would rise higher than the 1,250-foot-tall Empire State Building if placed on an ordinary city block; or would pave a standard highway 16 feet wide, from San Francisco to New York City.

In the U.S., as elsewhere in the world, sand and other aggregates are being extracted at a much faster rate than they can be replenished. Sand isn’t something that can be artificially manufactured. It as specific and depletable a resource as gold, lithium or precious resource. Like precious metals and minerals there is only so much usable sand to go around.

The best sands are those left in the wake of glacial meltwaters that act to clear away the clay and silt. Granular size and shape, along with the purity of the silica and resistance to crushing, are some of the characteristics distinguishing one sand from another.

Even a sluggish economy places significant pressures on available sand supplies. Although construction during the great recession of early in the 21st century slowed, road repairs, infrastructure build-out and maintenance continued. In the face of diminishing supplies these activities continue to be stressed.

The sands used for fracking, construction and industrial manufacture can’t just be whipped up in the laboratory. It takes eons and the right mix of chance factors and secret ingredients, e.g. glacial movements, water supply and the presence of base minerals, in the right proportions, for Nature to create the various types of sands so highly valued for their individual properties.

Rising prices, diminishing supplies and increasingly limited landfill space encourage recycling of construction and demolition materials in the U.S. and other developed nations. According to Britain’s Mineral Products Association, for example, recycled materials accounted for 28 percent of building materials used in Britain in 2014.

Recycling helps to lower the environmental impact of sand and aggregate mining. Laws, policies and financial incentives have a long way to go, however, before recycling can compensate much for diminishing supplies.

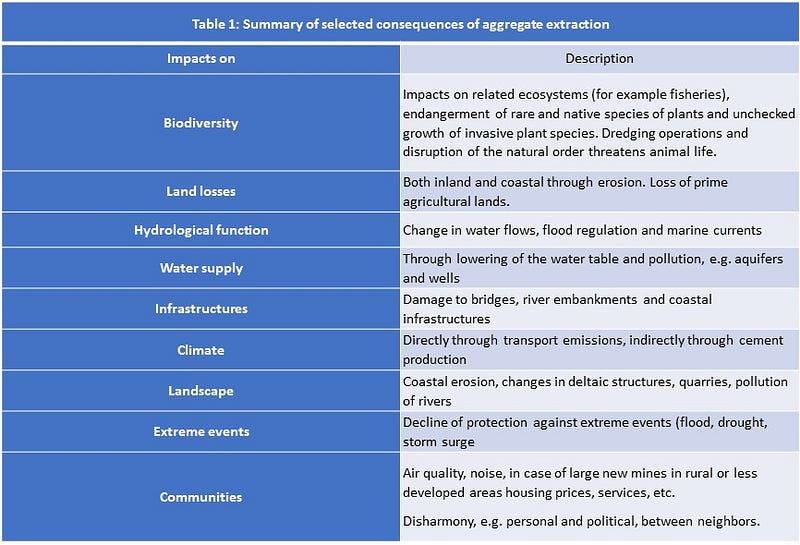

The environmental consequences of sand and aggregate mining are reasonably straightforward and typical of mining operations for other commodities like coal. As many of the operations are in rural areas, large mines can create typical boomtown problems associated with oil and gas drilling and exhibited in place like the Bakken shale fields and Canada’s oil sands communities. (See Table 1)

Source: http://www.greenfacts.org/en/sand-extraction/l-2/index.htm, note, however, author has added additional information.

A number of communities in prime sand states like Minnesota and Wisconsin are engaged in efforts to limit or prohibit sand mining operations. Winona County, Minnesota has successfully banned mining in the county after seventeen months of debate and at least one lawsuit challenging the decision.

Mining companies are not the only ones opposing such restrictions, however. Landowners whose right to sell or lease their properties for sums much greater than they might be worth as agricultural lands are understandably at odds with such decisions.

As the value of sand rises in response to market demands and supplies, community conflicts are likely to escalate. Environmental organizations like the Land Stewardship Project are making sand mining a priority and themselves available to assist local residents resist new and expanded mining operations.

Although sand is not a direct source of carbon emissions, it enables the fossil fuel industry and threatens water supplies, the natural defense against rising ocean levels. Low-carbon economies are not just about energy sources.

Construction — throughout its cycle — is a major contributor. Concrete is the most common man-made material on earth and a substantial component of the built environment. It is estimated that 10 percent of world carbon emissions come from concrete.

Sand as a major component of concrete, glass and other silicon based materials should not be ignored for its carbon contributions. Neither should the extraction and delivery process be left out of the climate change equation nor the effort to seek low-carbon alternatives.

Sand has societal implications beyond just its carbon contributions. Sand in the U.S. represents a potentially scarce and non-renewable resource, carrying with it significant environmental and economic consequences.

Elsewhere in the world sand’s societal impact goes beyond these two consequences to enter the arena of conflict minerals and illicit drugs.

Check for the second part of this article which will be posted soon. In that installment I will be discussing the sand wars of Asia and why it is not just sand, after all.

*Note there are inconsistencies in the statistics I have used in the article and chosen not to reconcile. Although sources are generally noted, they should be considered as representative weights and measures.

Photo: Hart Mining